Table of Contents

- 1. What Is Happening with Autonomous Vehicle (AV) Insurance?

- 2. Who Is Responsible for Accidents Involving AVs?

- 3. When Did Major Changes in AV Insurance Begin?

- 4. Where Are the Biggest Shifts in AV Insurance Taking Place?

- 5. Why Does Liability Matter?

- 6. How Are Insurers Responding?

- 7. What Does the Future Hold?

- 8. Sources and Further Reading (Outbound Links)

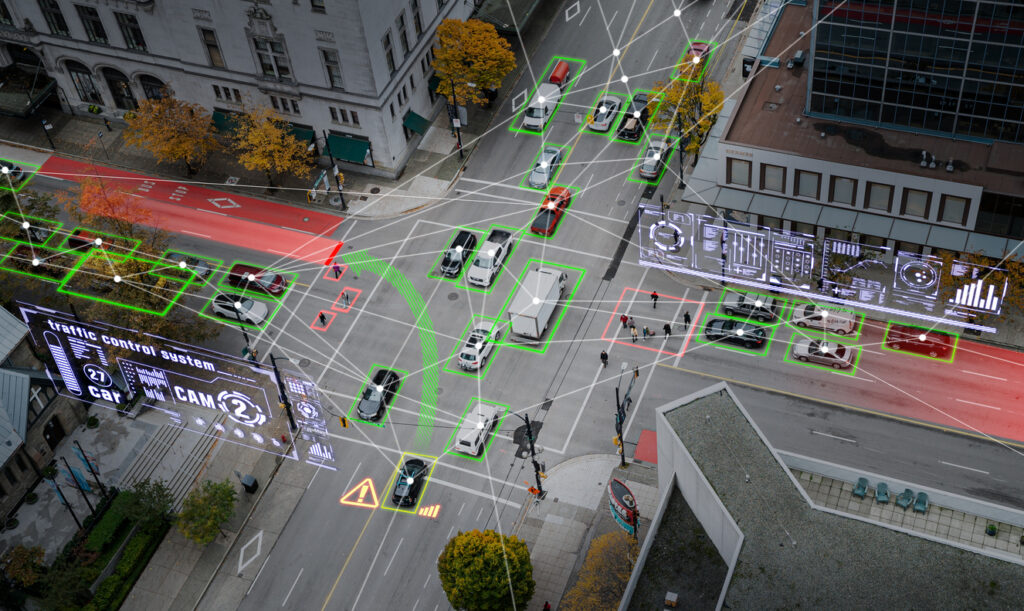

1. What Is Happening with Autonomous Vehicle (AV) Insurance?

- Increasing Adoption:

- As of March 2025, more consumers in the United States are buying or experimenting with autonomous and semi-autonomous vehicles.

- Testing programs by major tech and automotive companies (e.g., Waymo, Cruise, Tesla) continue to grow, leading to new insurance products and regulations.

- Shifting Insurance Models:

- Traditional auto insurance focuses on the driver being at fault.

- AV insurance often needs to account for the vehicle manufacturer or software developer being partly or fully liable if the autonomous system fails.

2. Who Is Responsible for Accidents Involving AVs?

- Drivers vs. Manufacturers:

- Level 2 or 3 AVs: Partial autonomy means the driver still holds some liability.

- Level 4 or 5 AVs: Near or fully autonomous modes shift a larger share of liability to the manufacturer or technology provider.

- Insurance Policies:

- Hybrid Coverage: Some policies split coverage between the individual driver (when operating manually) and the manufacturer (when AV tech is engaged).

- Product Liability: If a software glitch or design flaw causes an accident, product liability policies may come into play.

3. When Did Major Changes in AV Insurance Begin?

- Key Milestones:

- 2018–2020: Early pilot programs and state-level regulations emerged in places like California and Arizona.

- 2021–2023: More states (e.g., Texas, Florida) introduced laws to permit driverless cars on public roads. Insurers began rolling out specialized coverage.

- 2024–2025: Rapid AV deployment in commercial fleets (ride-hailing, freight) accelerated the need for clear insurance guidelines nationwide.

4. Where Are the Biggest Shifts in AV Insurance Taking Place?

- California

- Regulatory Environment: Home to many AV tech companies (Waymo, Cruise, Zoox). Requires $5 million in coverage for companies testing autonomous vehicles.

- Insurance Focus: Stringent reporting of disengagements; insurers rely on DMV-mandated crash data. Hybrid policies combine personal and product liability.

- Arizona

- Pro-Business Stance: Executive orders encourage AV testing. Warm climate allows year-round testing (e.g., Waymo’s ride-hailing service in Phoenix).

- Insurance Emphasis: Commercial AV policies with higher coverage limits. Detailed crash data required by insurers to establish fault.

- Texas

- Freight and Logistics: Ideal for autonomous trucks due to extensive highway networks. Laws permit fully driverless operation under specific conditions.

- Insurance Adaptations: Commercial fleet coverage with higher liability limits. Telematics used to verify accident details and set rates.

- Florida

- Early Legislative Adoption: Among the first states to allow AV operation without a human driver. Focus on tourism, pilot projects (e.g., Orlando shuttle tests).

- Insurance Requirements: $1 million minimum coverage for fully autonomous vehicles. Florida’s no-fault system could shift if AV tech is at fault.

5. Why Does Liability Matter?

- Legal Complexity:

- Determining fault can involve multiple parties, including the driver, manufacturer, and software developer.

- Financial Implications:

- Higher coverage limits may be required to cover potential technology failures.

- Product liability lawsuits can result in substantial payouts if a system-wide defect is proven.

6. How Are Insurers Responding?

- Higher Coverage Limits:

- Commercial entities (ride-hailing, freight) often need policies up to $5 million or more.

- Usage-Based Pricing:

- Telematics: Real-time data tracking influences premiums based on safe or at-risk behavior.

- Hybrid & On-Demand Policies:

- Some carriers testing on-demand coverage for fully autonomous mode vs. human-driven mode.

- Partnerships between automakers and insurers bundle AV purchases with specialized coverage.

7. What Does the Future Hold?

- Federal Guidance:

- The National Highway Traffic Safety Administration (NHTSA) is exploring standardized rules that could create a uniform insurance framework across states.

- Expanding Commercial Use:

- Commercial fleets (delivery vans, long-haul trucks) will likely drive further growth in AV insurance products.

- Consumer Acceptance:

- If autonomous vehicles reduce accident rates, auto insurance premiums may drop, though product liability costs for manufacturers could rise.

8. Sources and Further Reading (Outbound Links)

- California DMV – Autonomous Vehicles

- Arizona Governor’s Office – Executive Orders on Autonomous Vehicles

- Texas Department of Transportation – Automated Vehicles

- Florida Senate – Autonomous Vehicle Regulations

- National Conference of State Legislatures (NCSL) – Autonomous Vehicle State Laws

- NHTSA – Automated Driving Systems

- Insurance Information Institute – Emerging Issues in Autonomous Vehicles

Disclaimer: Regulations, insurance requirements, and the legal landscape can change rapidly. Always consult the latest state regulations or an insurance professional for the most current information.